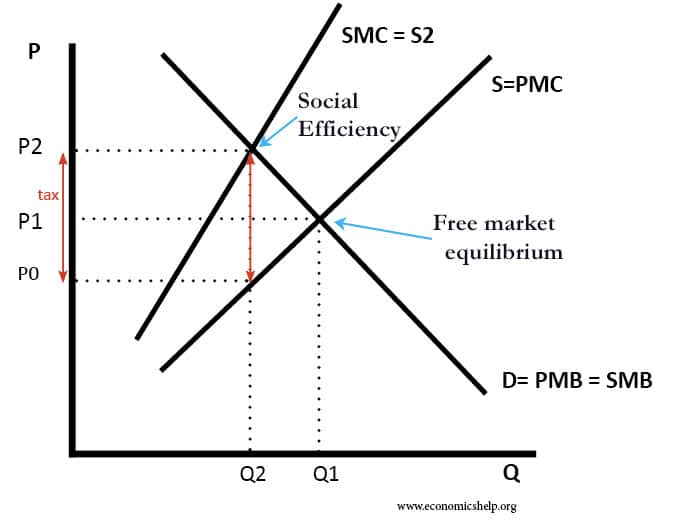

Indirect taxes

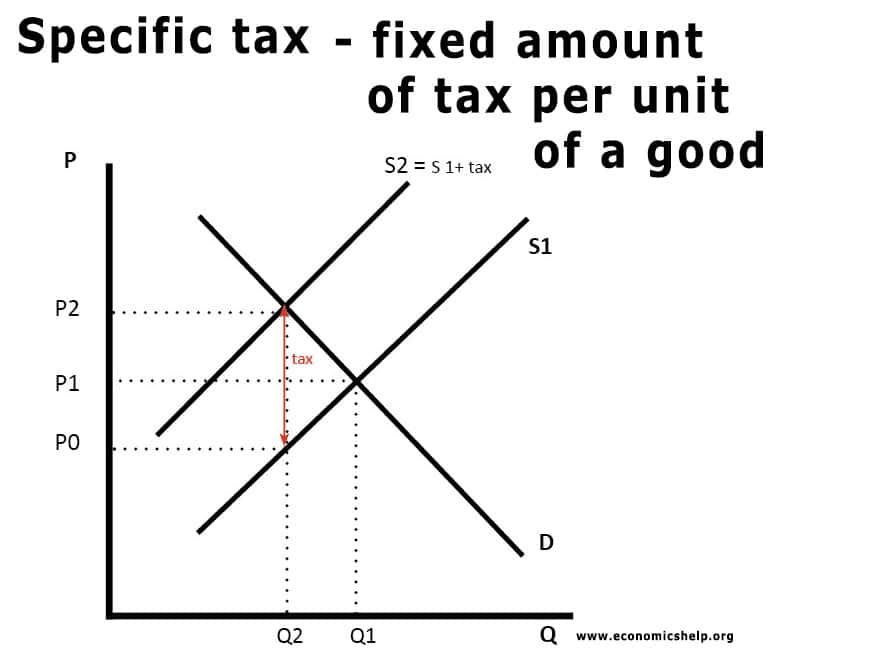

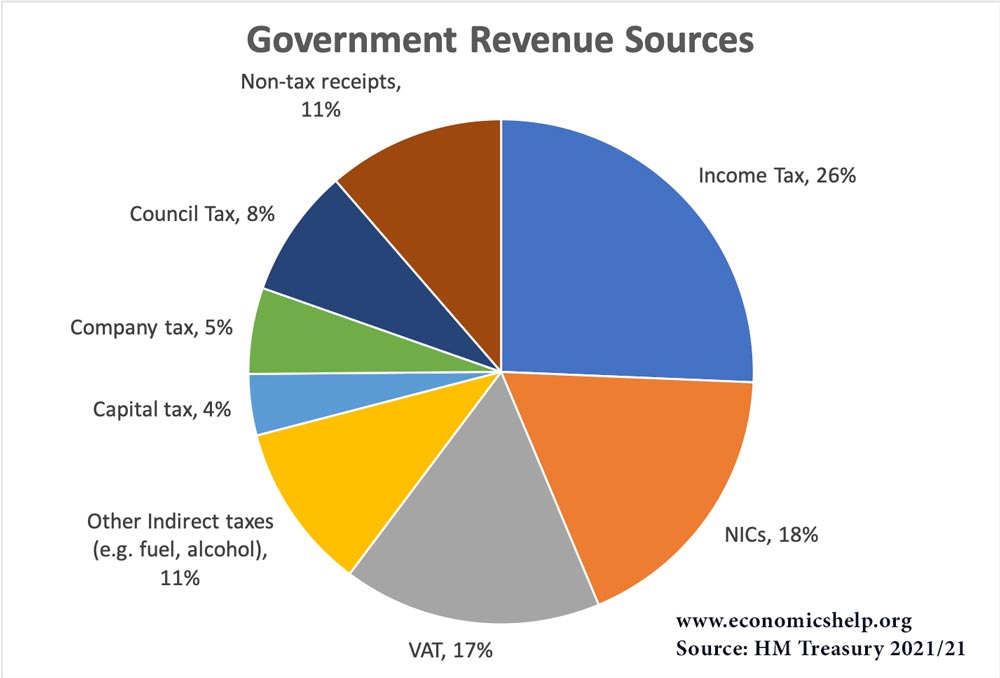

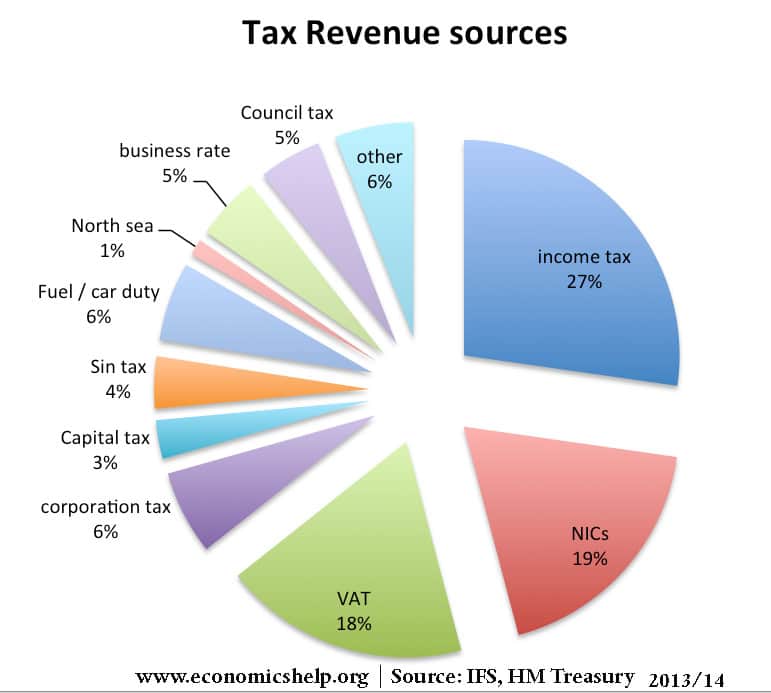

An indirect tax is charged on producers of goods and services and is paid by the consumer indirectly. Examples of indirect taxes include VAT, excise duties (cigarette, alcohol tax) and import levies. Example of VAT as an indirect tax VAT rates may be set at 20%. This percentage tax is known as an ad Valorem …